If you’re a SaaS founder in Australia considering an exit, you’re facing a unique challenge: you’ve built a globally competitive product from the edge of the world’s major tech markets. While your American and European counterparts are surrounded by buyers, you’re operating in relative isolation—or are you?

Here’s what most Australian founders don’t realise: in 2026, your geographic location is increasingly irrelevant to your business value. International buyers—particularly US private equity firms and strategic acquirers—are actively seeking well-run Australian SaaS businesses. They value the quality of Australian tech talent, appreciate the stable regulatory environment, and see tremendous opportunity in acquiring proven businesses at what they consider reasonable multiples.

The challenge isn’t finding buyers willing to pay fair value for your SaaS business. It’s accessing those buyers in the first place.

This is where most Australian founders make a costly mistake: they either undervalue their business (assuming they can only sell locally), attempt to navigate international sales alone (risking deal failure and security issues), or waste months on platforms that don’t attract serious buyers for mid-market SaaS.

In this comprehensive guide, we’ll break down:

- What international buyers are actually paying for Australian SaaS businesses in 2026

- Current valuation multiples and how they compare to US deals

- Why Australian SaaS businesses often command premium valuations globally

- The critical metrics that drive six-figure valuation differences

- How to access international buyers without the typical risks Australian founders face

Let’s explore what your SaaS business is really worth—and how to capture that value.

Table of Contents

- The Australian SaaS Opportunity in 2026

- Current Market Multiples for Australian SaaS

- Why Australian SaaS Businesses Attract International Buyers

- The Three Valuation Methodologies

- What Drives Premium Valuations

- Australian Founder Challenges and Solutions

- Currency and Cross-Border Considerations

- How to Increase Your Valuation

- Accessing International Buyers Safely

- Common Valuation Mistakes Australian Founders Make

- Next Steps for Australian SaaS Founders

The Australian SaaS Opportunity in 2026

Australian SaaS founders often underestimate their market position. You’ve built businesses that compete globally whilst operating from Sydney, Melbourne, Brisbane, or Perth. This geographic disadvantage has actually become an advantage in 2026.

The Current Market Reality

US private equity firms are hunting for Australian SaaS deals. Here’s why:

1. Quality Without the Premium

American PE firms see Australian SaaS businesses as high-quality acquisitions without the inflated valuations common in Silicon Valley. A Melbourne-based SaaS with strong metrics might sell for 5-6x ARR, whilst a comparable San Francisco company demands 8-10x.

American PE firms see Australian SaaS businesses as high-quality acquisitions without the inflated valuations common in Silicon Valley. A Melbourne-based SaaS with strong metrics might sell for 5-6x ARR, whilst a comparable San Francisco company demands 8-10x.

2. AUD/USD Exchange Rate Dynamics

With the Australian dollar sitting around USD $0.63-0.68 (as of early 2026), US buyers have purchasing power. What costs them less in absolute USD terms represents significant AUD value for you as the seller.

With the Australian dollar sitting around USD $0.63-0.68 (as of early 2026), US buyers have purchasing power. What costs them less in absolute USD terms represents significant AUD value for you as the seller.

3. Proven Business Models

Australian founders typically bootstrap longer, achieving stronger unit economics before raising capital. International buyers value this capital efficiency and proven profitability.

Australian founders typically bootstrap longer, achieving stronger unit economics before raising capital. International buyers value this capital efficiency and proven profitability.

4. Time Zone Coverage

Your business can service both US west coast and Asian markets effectively—a 24-hour coverage advantage that strategic acquirers pay premiums for.

Your business can service both US west coast and Asian markets effectively—a 24-hour coverage advantage that strategic acquirers pay premiums for.

5. Stable Jurisdiction

Australia’s political stability, robust legal system, and predictable regulatory environment make cross-border acquisitions lower risk for international buyers.

Australia’s political stability, robust legal system, and predictable regulatory environment make cross-border acquisitions lower risk for international buyers.

The Challenge for Australian Founders

Despite this opportunity, Australian SaaS founders face significant barriers:

Geographic Isolation:

- Limited access to US/European buyer networks

- Difficulty attending in-person meetings with potential acquirers

- Time zone challenges for real-time negotiations

Knowledge Gaps:

- Unfamiliarity with international M&A processes

- Uncertainty about cross-border legal and tax implications

- Limited understanding of what international buyers actually value

Risk Concerns:

- Currency exchange volatility

- Escrow and payment security for international transactions

- Foreign Investment Review Board (FIRB) requirements for larger deals

- Ensuring funds actually transfer successfully

Market Access:

- General Australian business brokers lack international buyer networks

- Online marketplaces attract primarily individual buyers, not institutional capital

- Direct outreach to US PE firms risks confidentiality and wastes time

This is precisely why the right advisory and buyer network access matters enormously for Australian founders.

Through our exclusive Australian partnership with Website Closers—a US-based firm with over 15 years and $1B+ in transaction history—we provide Australian SaaS founders with direct access to 40,000+ qualified international buyers, whilst managing all the cross-border complexities from right here in Melbourne.

Current Market Multiples for Australian SaaS

Let’s cut through the noise and examine what Australian SaaS businesses are actually selling for in early 2026.

International Buyer Multiples for Australian SaaS

Based on transactions we’ve facilitated for Australian founders accessing international buyers:

Business Profile | ARR Multiple Range | Typical Buyers |

|---|---|---|

Bootstrapped, $500K-$1M ARR | 4-5.5x | US/AU individual buyers, search funds |

Bootstrapped, $1M-$3M ARR | 4.5-6.5x | US PE, strategic acquirers, search funds |

Growth SaaS, $1M-$5M ARR | 5.5-8x | US/EU strategic acquirers, PE firms |

Premium metrics, any size | 7-10x+ | Strategic acquirers with synergies |

Critical context: These multiples assume you’re accessing international buyers. Australian-only buyer pools typically offer 20-30% lower multiples.

Comparison: Local vs International Buyers

Here’s the reality Australian founders face:

Local Australian Buyers:

- Smaller pool of capital

- More conservative multiples (3-4.5x typical)

- Longer due diligence periods

- Often require seller financing

International Buyers (via proper channels):

- Abundant capital actively deploying

- Competitive multiples (4.5-8x typical)

- Professional, efficient processes

- Mostly all-cash deals

The difference of 1-2x multiple on a $2M ARR business is $2-4M in your pocket.

What Changed in 2026 for Australian Sellers?

Compared to 2024-2025, we’re seeing several positive trends:

✅ Increased US interest in Australian tech: American PE firms view Australia as attractive acquisition market

✅ AUD/USD creating opportunity: Exchange rate makes Australian businesses attractive to USD buyers

✅ Quality over hype: Post-correction market rewards sustainable metrics over pure growth

✅ Remote proven: COVID permanently normalised remote teams, reducing geographic discount

✅ AI premium: Australian SaaS with genuine AI features seeing 15-25% valuation bumps

✅ AUD/USD creating opportunity: Exchange rate makes Australian businesses attractive to USD buyers

✅ Quality over hype: Post-correction market rewards sustainable metrics over pure growth

✅ Remote proven: COVID permanently normalised remote teams, reducing geographic discount

✅ AI premium: Australian SaaS with genuine AI features seeing 15-25% valuation bumps

Melbourne and Sydney SaaS Market Specifics

The Australian tech ecosystem—particularly Melbourne and Sydney—has matured significantly:

Melbourne SaaS scene:

- Strong enterprise SaaS development

- FinTech and RegTech strength

- Known for capital-efficient growth

- International buyers recognise the talent base

Sydney SaaS scene:

- B2B SaaS strength

- Proximity to Asian markets valued

- Established startup ecosystem

- Track record of successful exits

Brisbane and Perth:

- Emerging tech hubs

- Often overlooked by local buyers (opportunity for international reach)

- Lower operational costs reflected in stronger unit economics

Why Australian SaaS Businesses Attract International Buyers

Understanding why international buyers seek Australian SaaS companies helps you position your business for maximum value.

The Australian Advantage

1. Engineering Quality

Australian developers have excellent global reputations. International buyers trust the technical foundation of Australian-built software.

Australian developers have excellent global reputations. International buyers trust the technical foundation of Australian-built software.

2. Bootstrap Culture = Better Unit Economics

Australian founders typically:

Australian founders typically:

- Raise less venture capital

- Focus on profitability earlier

- Build sustainable business models

- Demonstrate stronger CAC payback and LTV:CAC ratios

US buyers, tired of unprofitable growth-at-all-costs businesses, value this approach.

3. English-Speaking, Western Culture

- No language barriers in customer communication

- Documentation already in English

- Cultural alignment with US/UK buyers

- Easy team integration post-acquisition

4. Geographic Positioning

- Service US evening/night via Australian daytime

- Cover Asian business hours

- True 24-hour operation possible

- Multi-region customer base is easier

5. Regulatory Clarity

- Stable legal environment

- Clear IP law

- Predictable tax regime

- Lower political risk than many markets

6. Untapped Market Perception

Many US buyers see Australian SaaS as “undiscovered” compared to overcrowded US market, believing they’re getting better value.

Many US buyers see Australian SaaS as “undiscovered” compared to overcrowded US market, believing they’re getting better value.

What International Buyers Look For in Australian SaaS

US Private Equity Firms want:

- Proven revenue ($1M+ ARR minimum typically)

- Strong retention (>100% NRR preferred)

- Capital efficiency

- Scalable operations

- Clean financials and metrics

- Low founder dependency

Strategic Acquirers (US/EU companies) want:

- Complementary technology or customer base

- Geographic expansion opportunity

- Talent acquisition

- Competitive positioning

- Technology or IP

Search Funds want:

- $500K-$3M ARR businesses

- Profitable or near-profitable

- Owner-operated businesses they can step into

- Clear growth runway

- Reasonable seller support during transition

The Risk for Australian Founders Going Direct

Many Australian founders try to approach international buyers directly. This creates several problems:

1. Time Zone Complexity

Coordinating due diligence across 12-18 hour time differences extends deals by months and exhausts both parties.

Coordinating due diligence across 12-18 hour time differences extends deals by months and exhausts both parties.

2. Legal and Tax Complexity

Cross-border M&A requires expertise in both Australian and buyer jurisdiction. DIY attempts often fail during legal documentation.

Cross-border M&A requires expertise in both Australian and buyer jurisdiction. DIY attempts often fail during legal documentation.

3. Currency Risk

Without proper hedging strategies, exchange rate movements between LOI and closing can cost six figures.

Without proper hedging strategies, exchange rate movements between LOI and closing can cost six figures.

4. Payment Security

Ensuring international wire transfers arrive safely requires proper escrow—which many Australian founders don’t know how to structure.

Ensuring international wire transfers arrive safely requires proper escrow—which many Australian founders don’t know how to structure.

5. FIRB Complications

Larger transactions may require Foreign Investment Review Board approval. Missing this step can invalidate deals.

Larger transactions may require Foreign Investment Review Board approval. Missing this step can invalidate deals.

6. Confidentiality Breaches

Direct outreach to potential buyers can alert competitors or destabilise your business if word gets out.

Direct outreach to potential buyers can alert competitors or destabilise your business if word gets out.

This is why the right partner—based in Australia, with established international networks—is critical.

The Three Valuation Methodologies

Different Australian SaaS businesses should be valued using different approaches. Here’s when to use each.

1. ARR (Annual Recurring Revenue) Multiple

Best for: Subscription-based SaaS with predictable recurring revenue

How it works: Valuation = ARR × Multiple

Example:

- ARR: $2,000,000

- Multiple: 5.5x (based on metrics and buyer type)

- Valuation: $11,000,000

When to use: This is the gold standard for SaaS. If you have true recurring revenue, this should be your primary methodology.

Australian context: International buyers typically use ARR multiples. Some Australian buyers may use SDE (Seller’s Discretionary Earnings) instead—this often results in lower valuations.

2. SDE (Seller’s Discretionary Earnings) Multiple

Best for: Smaller, owner-operated SaaS businesses (typically <$1M ARR)

How it works:

- Calculate annual profit

- Add back owner salary, discretionary expenses, one-time costs

- Multiply by 3.5-5x

Example:

- Revenue: $800,000

- Expenses: $550,000

- Owner Salary: $120,000

- SDE: $370,000

- Multiple: 4.5x

- Valuation: $1,665,000

When to use: When the business is still heavily owner-dependent and doesn’t have established recurring revenue predictability.

Australian context: Many Australian accountants and local brokers default to SDE methodology. However, if you can demonstrate true ARR, international buyers will use revenue multiples—typically resulting in higher valuations.

3. EBITDA Multiple

Best for: Larger, mature SaaS businesses (typically $10M+ ARR) with profitability and scale

How it works: Valuation = EBITDA × Multiple (typically 10-15x for established SaaS)

When to use: When the business has achieved scale, has a management team in place, and profitability is a key feature.

Australian context: Only relevant for larger Australian SaaS companies approaching institutional investment size.

Which Multiple Should Australian Founders Use?

Here’s our decision framework:

IF ARR > $5M AND profitable → Start with EBITDA, cross-check ARR

IF ARR $1-5M with recurring → Use ARR multiple (fight for this vs SDE)

IF ARR < $1M or owner-operated → Expect both SDE and ARR analysis

IF unprofitable but growing fast → ARR multiple with growth premium

Critical for Australian founders: Don’t let local advisers or buyers push you into SDE methodology if you have genuine recurring revenue. ARR multiples almost always yield higher valuations.

What Drives Premium Valuations

Not all $2M ARR Australian SaaS businesses are valued equally. Some sell for $8M (4x) whilst others command $14M (7x). Here’s what creates that difference.

1. Net Revenue Retention (NRR)

This is the single most important metric for international buyers.

What it is: How much revenue you retain and expand from existing customers over time.

Benchmarks:

- Below 90%: Red flag, expect valuation discount

- 90-100%: Acceptable for SMB SaaS

- 100-110%: Good, at-market multiples

- 110-120%: Strong, premium multiple territory

- 120%+: Exceptional, significant premium (rare, highly valued)

Why it matters to international buyers: A business with 120% NRR is growing even without new customer acquisition. This is pure gold—especially for PE buyers who may not excel at new customer generation.

Real impact: Moving from 95% NRR to 115% NRR can increase your multiple by 1-2x.

2. Churn Rate

Monthly benchmarks by customer type:

- SMB SaaS: 3-5% monthly churn (acceptable)

- Mid-market: 2-3% monthly churn (good)

- Enterprise: <1% monthly churn (excellent)

Annual churn benchmarks:

- Above 40%: Major concern, significant discount

- 25-40%: Manageable for SMB, slight discount

- 15-25%: Good for most SaaS, market multiple

- Below 15%: Premium territory

Why it matters: International buyers are sophisticated—they know high churn means you’re on a treadmill. Low churn means compounding growth.

Australian context: Some Australian founders don’t track churn properly. Implementing proper cohort-based retention tracking before approaching buyers is essential.

3. Customer Acquisition Cost (CAC) Payback Period

How long does it take to recoup customer acquisition cost?

Benchmarks:

- <6 months: Exceptional (premium multiple)

- 6-12 months: Strong (market multiple)

- 12-18 months: Acceptable (baseline)

- 18 months: Concerning (discount or deal killer)

Formula: CAC ÷ (Monthly recurring revenue per customer × Gross margin)

Why it matters: Fast payback means you can reinvest quickly and scale efficiently. Slow payback creates cash constraints.

4. LTV:CAC Ratio

Lifetime Value to Customer Acquisition Cost ratio

Benchmarks:

- Below 3:1 → Unsustainable, significant discount

- 3:1 to 5:1 → Healthy, baseline multiple

- 5:1 to 7:1 → Excellent, premium multiple

- Above 7:1 → Outstanding (or underinvesting in growth)

Why it matters: This ratio shows unit economics health. International buyers won’t acquire businesses with poor unit economics.

Australian advantage: Bootstrap culture means many Australian SaaS businesses have excellent LTV:CAC ratios compared to venture-funded US counterparts.

5. Growth Rate

Year-over-year ARR growth:

Growth Rate | Multiple Impact | Buyer Interest |

|---|---|---|

<20% | Base multiple or discount | Lower tier buyers |

20-40% | Market multiple | Broad buyer interest |

40-60% | Premium multiple (+20-30%) | Strategic acquirers interested |

60-100% | Significant premium (+40-60%) | Competitive bidding likely |

>100% | Exceptional premium | Must be sustainable |

Important: International buyers care about sustainable growth. A spike followed by decline is worse than steady, modest growth.

6. The Rule of 40

Formula: Growth Rate (%) + Profit Margin (%) ≥ 40

Examples:

- 50% growth + (-10%) margin = 40 ✓

- 30% growth + 15% margin = 45 ✓

- 20% growth + 10% margin = 30 ✗

Businesses meeting the Rule of 40 command premium multiples from international buyers because they balance growth with efficiency.

Australian context: Bootstrap-focused Australian SaaS businesses often excel here, having been forced to focus on efficiency earlier than US counterparts.

7. Geographic Revenue Diversification

Revenue by region matters to international buyers:

Ideal for Australian SaaS:

- 40-60% Australian/NZ customers (home market validation)

- 30-50% US customers (key growth market)

- 10-20% Europe/Asia (diversification)

Red flag:

- 80% Australian-only revenue (limited growth perception)

- 100% US revenue (why is it Australian-based?)

Premium positioning:

- Multi-region customer base

- Proven ability to serve different time zones

- No single geography >60% revenue

8. Other Premium Factors Beyond Metrics

International buyers pay premiums for:

- Clean corporate structure: PTY LTD with clear ownership, up-to-date ASIC filings

- Strong IP position: Properly assigned employee IP, clear ownership

- Documented operations: Can run without founder for 3+ months

- Quality Australian team: Talent that will stay post-acquisition

- Scalable infrastructure: Modern tech stack, documented, secure

- Brand recognition: Thought leadership in niche

- Strategic fit: Solves problem for acquirer’s customers

- Data compliance: GDPR-ready if servicing EU, privacy law compliant

Australian Founder Challenges and Solutions

Let’s address the specific challenges Australian SaaS founders face when selling internationally.

Challenge 1: Time Zone Barriers

Problem: Coordinating due diligence and negotiations across 12-18 hour time differences with US buyers.

DIY Risk: Deals drag on for 8-12 months due to communication delays.

Solution: Working with an Australian-based adviser who has US partnerships means:

- Local time zone for you (Melbourne/Sydney business hours)

- US team handles US buyer communications in their hours

- 24-hour deal progression

- Eliminates the exhaustion of midnight calls

Our approach: We’re based in Melbourne but our Website Closers partnership means US buyers get real-time responses during their business hours whilst you maintain work-life balance.

Challenge 2: Currency and Exchange Rate Risk

Problem: Deals are typically priced in USD. Between signing LOI and closing (4-8 weeks), AUD/USD can move 2-5%.

Example risk:

- LOI signed: USD $8M at 0.67 AUD/USD = $11.94M AUD

- Closing 6 weeks later: 0.64 AUD/USD = $12.5M AUD

- Difference: $560K (but could go the other way)

DIY Risk: Australian founders often don’t hedge currency risk and can lose hundreds of thousands.

Solution: Proper cross-border advisers help you:

- Understand currency implications

- Consider forward contracts to lock in rates

- Structure payment timing to minimise exposure

- Know when to hedge and when to accept risk

Challenge 3: Cross-Border Legal Complexity

Problem: Purchase agreements must satisfy both Australian and buyer jurisdiction requirements.

DIY Risk:

- Using only Australian lawyer who doesn’t understand US M&A norms

- Missing critical protections

- Deal structures that create tax inefficiencies

- Unenforceable provisions

Solution: Working with advisers experienced in cross-border SaaS M&A means:

- Coordinating Australian and US legal counsel

- Ensuring deal structure optimises for both jurisdictions

- Avoiding common pitfalls

- Standard international escrow arrangements

Our network: We connect Australian founders with M&A lawyers who specialise in cross-border tech transactions—they understand both Australian tax implications and international buyer requirements.

Challenge 4: Payment Security and Escrow

Problem: Ensuring $5-15M+ actually transfers safely from international buyer.

Legitimate concerns:

- Wire fraud attempts

- Escrow agent reliability

- Multi-currency transfers

- FIRB holds on funds (if applicable)

DIY Risk: Australian founders using unfamiliar escrow services or wire transfer processes can encounter serious problems.

Solution: Established cross-border processes including:

- Reputable international escrow (Escrow.com standard for online business sales)

- Verified wire instructions with multiple confirmation points

- Understanding of international payment timing

- Fraud prevention protocols

Challenge 5: Limited Access to Serious Buyers

Problem: Most Australian founders don’t have access to:

- US private equity firms actively acquiring SaaS

- Strategic acquirers with acquisition mandates

- Well-funded search funds

- International portfolio acquirers

DIY Risk:

- Listing on marketplaces that primarily attract individual buyers

- Cold outreach to US PE firms (rarely works, risks confidentiality)

- Relying on local Australian buyer pool (limited capital, lower multiples)

- Missing out on competitive bidding

Solution: Access to established international buyer networks.

Our differentiation: Through Website Closers, we provide direct access to 40,000+ qualified international buyers including:

- US private equity firms with SaaS acquisition mandates

- Strategic acquirers actively seeking Australian businesses

- Well-funded search funds

- International individual buyers with verified capital

This isn’t just a database—it’s 15+ years of relationships and proven transaction history.

Challenge 6: Understanding What International Buyers Value

Problem: Australian founders often don’t know how to position their business for international buyers.

Common mistakes:

- Emphasising features international buyers don’t care about

- Missing metrics international buyers require

- Wrong revenue recognition presentation

- Not addressing perceived risks

Solution: Guidance from advisers who know what different buyer types value:

- US PE firms care most about: NRR, CAC payback, Rule of 40

- Strategic acquirers care about: Customer overlap, technology fit, talent

- Search funds care about: Profitability, owner transition, growth potential

Currency and Cross-Border Considerations

Let’s demystify the financial mechanics of selling your Australian SaaS business to international buyers.

How Deals Are Typically Structured

Purchase Price Currency:

- Almost always priced in USD for international buyers

- Australian buyers may transact in AUD

- Final AUD amount depends on exchange rate at settlement

Example:

- Agreed price: USD $10M

- Exchange rate at closing: 0.65 AUD/USD

- You receive: $15.38M AUD

Tax Implications for Australian Founders

Capital Gains Tax (CGT) Considerations:

Australian business owners benefit from Small Business CGT Concessions when selling:

Available concessions (if eligible):

- 50% Active Asset Reduction: Reduces capital gain by 50%

- Retirement Exemption: Up to $500,000 tax-free (if conditions met)

- 15-Year Exemption: Complete exemption if you’ve owned business 15+ years and retiring

Eligibility generally requires:

- Business turnover <$2M or net assets <$6M (check current thresholds)

- Active asset test met

- Australian tax resident

- Other specific conditions

Critical: Engage an M&A tax specialist 6-12 months before selling. Proper structuring can save you hundreds of thousands in tax.

Asset vs Share Sale:

- Share sale often more tax-efficient for sellers (CGT concessions apply)

- Asset sale sometimes required by buyers (especially US buyers)

- Structure impacts your tax outcome significantly

We connect Australian founders with tax specialists who understand:

- Cross-border SaaS transactions

- CGT optimisation strategies

- Deal structure tax implications

- Both Australian and international requirements

FIRB (Foreign Investment Review Board)

When it applies:

- Foreign buyers acquiring Australian businesses above certain thresholds

- Generally $1,281M+ for US investors (as of 2026, check current)

- Lower thresholds for certain sensitive sectors (usually not SaaS)

- Can apply to smaller deals in some circumstances

Impact if required:

- Adds 30-90 days to timeline

- Requires formal application

- Government approval needed before completion

- Usually straightforward for SaaS businesses

Most SaaS sales don’t trigger FIRB, but worth confirming with advisers.

Payment Mechanics

Typical process:

- LOI signed (usually in USD)

- Due diligence period (4-8 weeks)

- Purchase agreement executed

- Buyer deposits funds to escrow (USD)

- Conditions satisfied

- Escrow releases funds (wire to your Australian bank)

- Your bank converts USD to AUD (or you arrange)

- Portion held in escrow (typically 6-18 months)

Wire transfer considerations:

- International wires take 2-5 business days

- Bank fees both sides (plan for 0.1-0.3% in fees)

- Exchange rate applied at conversion time

- Need correct SWIFT codes and account details

Escrow standard:

- 5-15% of purchase price held for 6-18 months

- Released if no indemnification claims

- Standard practice for all M&A deals

How to Increase Your Valuation

If you’re 12-18 months from wanting to sell, here’s how Australian founders can maximise their SaaS business value.

High-Impact Actions for Australian SaaS Founders

1. Fix Your Metrics Tracking (Immediate)

International buyers expect proper SaaS metrics. Many Australian founders track revenue but not retention properly.

Implement:

- Cohort-based retention analysis

- Monthly recurring revenue (MRR) and ARR tracking

- Customer acquisition cost (CAC) by channel

- Lifetime value (LTV) calculations

- Net revenue retention (NRR)

- CAC payback period

Tools: ChartMogul, Baremetrics, or build custom dashboards

Impact: Proper metrics can increase valuation 0.5-1x multiple by building buyer confidence.

2. Improve Unit Economics (3-6 months)

Focus on the metrics international buyers care most about:

Reduce CAC:

- Optimise underperforming channels

- Improve conversion rates

- Leverage word-of-mouth and referrals

- Content marketing for organic acquisition

Increase LTV:

- Reduce churn through customer success

- Implement expansion revenue strategies

- Annual billing incentives

- Feature-based upsells

Target: Move LTV:CAC from 3:1 to 5:1+

Impact: Can increase multiple by 0.5-1.5x

3. Demonstrate International Reach (6-12 months)

Australian-only revenue limits perceived growth potential.

Strategies:

- Target US customers (even 20-30% US revenue helps)

- Pricing in USD (signals global positioning)

- US-friendly payment options (Stripe, US credit cards)

- Time zone coverage in support

- International testimonials and case studies

Impact: Geographic diversification can increase multiple by 0.25-0.75x

4. Reduce Founder Dependency (6-12 months)

International buyers want businesses they can operate without you.

Actions:

- Document all key processes

- Hire or train team on critical functions

- Delegate customer relationships

- Systematise sales and customer success

- Test absence (take 3-4 week holiday)

Target: Business runs smoothly for 30+ days without your involvement

Impact: Can increase multiple by 0.5-1.5x

5. Clean Corporate Structure (Immediate-3 months)

International buyers want clean Australian companies.

Checklist:

- PTY LTD with clear ownership structure

- Up-to-date ASIC filings

- All employee IP properly assigned

- Clean cap table (no messy ownership splits)

- Proper employee contracts

- Documented board resolutions

Impact: Reduces friction, avoids deal delays, maintains valuation

6. Prepare for International Due Diligence (3-6 months)

US buyers have different due diligence expectations than Australian buyers.

Prepare:

- Financial statements in both AUD and USD

- Revenue recognition properly documented

- All contracts organised and accessible

- Technical documentation (architecture, security, data)

- Customer data and retention analysis

- All corporate documents ready

Impact: Smooth due diligence = faster closing = higher completion rate

Accessing International Buyers Safely

The biggest decision Australian SaaS founders face: how do you actually access serious international buyers without the typical risks?

The Options (and Their Problems)

Option 1: Online Marketplaces (Flippa, Empire Flippers)

Pros:

- Easy to list

- Some buyer traffic

- Transparent process

Cons:

- Primarily attract individual buyers, not institutional capital

- Lower multiples (typically 3-4.5x)

- Public listing (confidentiality concerns)

- Limited support for complex cross-border deals

- Few serious PE or strategic acquirers

Best for: Smaller businesses (<$500K valuation)

Option 2: Australian Business Brokers

Pros:

- Local presence

- Understand Australian market

- Can help with local buyers

Cons:

- Limited or no international buyer networks

- Don’t understand SaaS metrics as well

- Rarely have PE or strategic acquirer relationships

- Lower multiples due to smaller buyer pool

- Not experienced in cross-border complexity

Best for: Traditional Australian businesses, not tech/SaaS

Option 3: Direct Outreach to US Buyers

Pros:

- No intermediary costs

- Direct relationships

Cons:

- Extremely difficult to get meetings

- Confidentiality risks

- Time zone complexity

- Don’t know which PE firms are actually acquiring

- Weak negotiating position (single buyer)

- Complex legal/tax/payment issues you handle alone

- High failure rate

Best for: Very few situations (rarely works)

Option 4: Australian Broker with International Network

Pros:

- Local presence and understanding

- Access to international buyers

- Cross-border transaction expertise

- Manage time zone complexity

- Handle currency and payment security

- Create competitive buyer process

- Higher multiples from institutional buyers

This is our model—and why it works uniquely well for Australian SaaS founders.

Why Digital Asset Brokers’ Approach Works

We’re solving the fundamental problem Australian SaaS founders face: you need international buyer access with Australian-based support.

Our structure:

Melbourne-based team who understand:

- Australian SaaS ecosystem

- Local tax and legal considerations

- PTY LTD structures

- Australian founder challenges

- Sydney/Melbourne/Brisbane tech scenes

Plus exclusive Australian partnership with Website Closers:

- US-based firm with 15+ years in online business M&A

- $1B+ in transaction history

- 40,000+ qualified international buyers

- Direct relationships with US PE firms, strategic acquirers, search funds

- 2,000+ successful business sales

- Established processes for cross-border SaaS deals

What this means for you:

✅ Local accessibility: We’re in your time zone, speak your language, understand your market

✅ International reach: Through Website Closers, access to serious US and international buyers

✅ Higher valuations: International buyers pay premium multiples vs local Australian buyers

✅ Competitive process: Multiple qualified buyers bidding on your business

✅ Cross-border expertise: We handle currency, legal coordination, escrow, payment security

✅ Faster timelines: Established processes mean 60-90 day average closings

✅ Risk mitigation: Proven protocols for international payments and legal protection

✅ International reach: Through Website Closers, access to serious US and international buyers

✅ Higher valuations: International buyers pay premium multiples vs local Australian buyers

✅ Competitive process: Multiple qualified buyers bidding on your business

✅ Cross-border expertise: We handle currency, legal coordination, escrow, payment security

✅ Faster timelines: Established processes mean 60-90 day average closings

✅ Risk mitigation: Proven protocols for international payments and legal protection

You get the best of both worlds: local support with global reach.

Common Valuation Mistakes Australian Founders Make

Learn from others’ errors. These mistakes cost Australian sellers hundreds of thousands in value.

Mistake 1: Assuming Only Australian Buyers

The error: “I’m an Australian business, so I’ll probably sell to an Australian buyer.”

Why it’s costly: Australian buyer pool is limited. International buyers (especially US) often pay 20-40% more for the same business.

Reality: Your SaaS business competes globally. Don’t limit yourself to a small local market.

Better approach: Access international buyers through proper channels whilst maintaining Australian legal/tax optimisation.

Mistake 2: Using SDE When You Should Use ARR

The error: Local accountants value your SaaS using Seller’s Discretionary Earnings instead of Annual Recurring Revenue.

Example:

- $1.5M ARR SaaS

- SDE methodology: $400K SDE × 4 = $1.6M valuation

- ARR methodology: $1.5M ARR × 5 = $7.5M valuation

Cost: $5.9M in lost value

Why it happens: Many Australian accountants and local brokers aren’t familiar with SaaS-specific valuation.

Better approach: Insist on ARR multiples if you have genuine recurring revenue. International buyers always use ARR for SaaS.

Mistake 3: Poor Currency Risk Management

The error: Signing LOI in USD without considering exchange rate risk between signing and closing.

Real scenario:

- LOI at USD $8M

- Exchange rate at LOI: 0.66 AUD/USD = $12.12M AUD

- Six weeks later at closing: 0.62 AUD/USD = $12.9M AUD

- Unexpected gain: $780K

Or it goes the other way:

- Exchange rate drops to 0.70: $11.43M AUD

- Unexpected loss: $690K

Better approach: Understand currency risk, consider hedging for large amounts, factor into negotiations.

Mistake 4: Not Understanding Cross-Border Tax

The error: Structuring deal without Australian M&A tax advice, missing CGT concessions.

Cost: Potentially 20-30% of proceeds in unnecessary tax.

Better approach: Engage tax specialist experienced in cross-border SaaS M&A 6-12 months before selling.

Mistake 5: Trying to Navigate International Sales Alone

The error: “I’ll save the commission and handle this myself with US buyers.”

Reality check:

- You don’t have access to serious PE buyers

- Time zone coordination is exhausting

- Cross-border legal/tax complexity is real

- Payment security requires expertise

- Negotiating alone means weak position

Cost: Lower sale price, deal failure, or both.

Better approach: For businesses >$1M valuation, specialist advisory pays for itself through higher sale prices and reduced risk.

Next Steps for Australian SaaS Founders

Whether you’re ready to sell now or planning for the future, here’s how to move forward.

If You’re Exploring (12+ Months from Exit)

Action steps:

- Get baseline valuation to understand current international market value

- Identify improvement areas (metrics, international customers, operations)

- Start tracking proper SaaS metrics (cohort retention, NRR, CAC payback)

- Consider US market expansion (even 20-30% US revenue helps)

- Clean corporate structure (IP assignments, proper contracts)

Free resources we offer:

- Business valuation using international market data

- Assessment of readiness for international sale

- Improvement recommendations

- Market positioning guidance

If You’re Seriously Considering (6-12 Months)

Action steps:

- Professional valuation with international comparable analysis

- Begin preparation (financials, documentation, reducing founder dependency)

- Engage M&A tax specialist for Australian cross-border planning

- Optimise key metrics international buyers care about

- Have conversation with international buyer network providers

What we offer:

- Comprehensive valuation with US comparable data

- Preparation roadmap for international sale

- Introduction to Australian M&A tax specialists

- Assessment of international buyer appeal

- Timeline and process planning

If You’re Ready to Sell (0-6 Months)

Action steps:

- Complete due diligence preparation for international buyers

- Engage specialist adviser with international network

- Finalise data room with international buyer requirements

- Legal and tax advisers in place for cross-border transaction

- Begin marketing to qualified international buyers

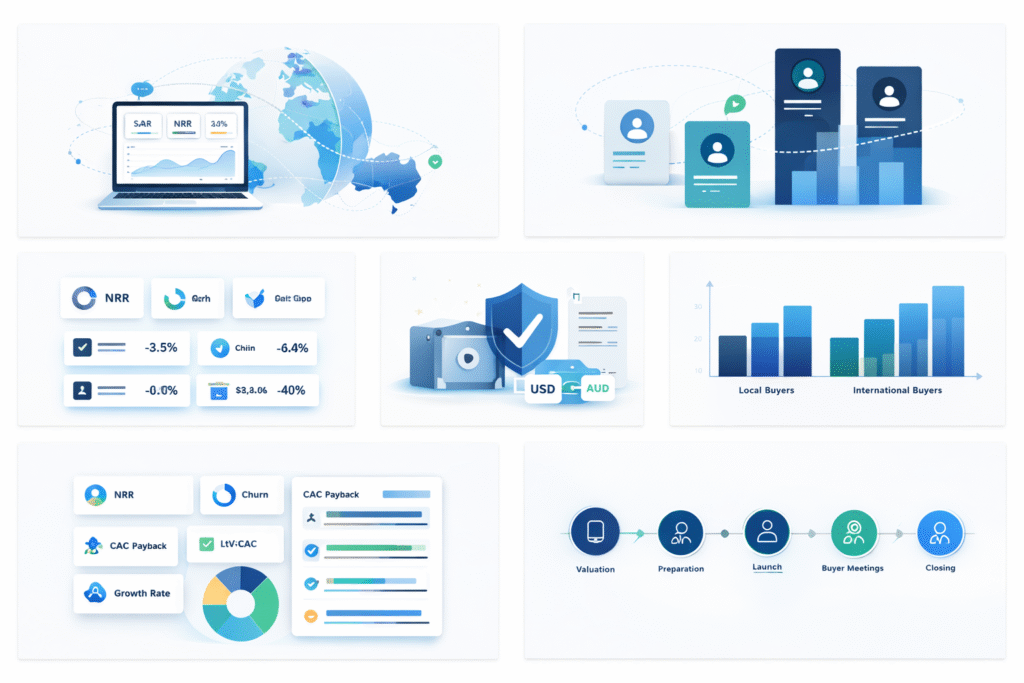

Our process:

Week 1-2: Valuation and international buyer positioning

Week 2-3: Prepare marketing materials and comprehensive data room

Week 4: Launch to Website Closers’ international buyer network

Week 4-8: Qualified buyer meetings and LOI negotiations

Week 8-12: Due diligence with chosen buyer

Week 12-16: Final negotiations, legal documentation, and closing

Week 2-3: Prepare marketing materials and comprehensive data room

Week 4: Launch to Website Closers’ international buyer network

Week 4-8: Qualified buyer meetings and LOI negotiations

Week 8-12: Due diligence with chosen buyer

Week 12-16: Final negotiations, legal documentation, and closing

Average timeline: 60-90 days from engagement to closing with international funds in your Australian bank account.

How We Help Australian SaaS Founders

We’re uniquely positioned to help Australian SaaS founders access international buyers safely and achieve maximum valuations.

Free Valuation for Australian SaaS Founders

What you receive:

- International market valuation using 2026 US buyer data

- Comparison to recent Australian and international SaaS sales

- Assessment against metrics international buyers require

- Currency and cross-border considerations

- Improvement recommendations to increase value

- Expected buyer types and market positioning

- Realistic timeline and process overview

What we need:

- Last 2-3 years financials

- SaaS metrics (MRR, ARR, churn, retention)

- Customer data summary

- Geographic revenue breakdown

- Basic operational overview

Timeline: 3-5 business days

Commitment: None. Genuinely free assessment.

Commitment: None. Genuinely free assessment.

This helps you understand what international buyers would actually pay vs local Australian valuations.

Consultation with Australian M&A Specialists

30-minute call covering:

- Your business and exit goals

- International market conditions for Australian SaaS

- Preliminary valuation range

- Preparation requirements for international sale

- Our process and Website Closers partnership

- Currency, tax, and cross-border considerations

- Your questions answered

Why Australian Founders Choose Us

Melbourne-based with international reach:

- We’re in Armadale, Victoria—accessible to Australian founders

- Understand Australian SaaS ecosystem and challenges

- Work in your time zone

- Navigate local tax and legal requirements

Plus Website Closers partnership:

- Access to 40,000+ qualified international buyers

- $1B+ in transaction history

- Direct relationships with US PE firms actively acquiring

- Established cross-border transaction processes

- 2,000+ successful business sales

Our results for Australian founders:

- 25-40% higher sale prices vs local Australian buyer market

- 60-90 day average closing time

- 94% success rate for listed businesses

- Comprehensive cross-border support

- Currency, legal, tax, payment security all handled

You focus on running your business. We handle accessing international buyers and navigating cross-border complexity.

Conclusion

Australian SaaS founders are in a unique position in 2026. You’ve built globally competitive businesses, often with stronger unit economics than venture-funded US counterparts. International buyers—particularly US private equity firms and strategic acquirers—actively seek Australian SaaS companies.

The challenge isn’t building value. It’s accessing the buyers who will pay fair international multiples whilst managing the complexity of cross-border M&A.

Key takeaways:

- International buyers pay 20-40% more than local Australian buyers for the same SaaS business

- ARR multiples (4.5-8x) beat SDE valuations for recurring revenue businesses

- Proper metrics tracking can increase valuations by 0.5-2x multiple

- Geographic revenue diversification (especially US customers) commands premiums

- Cross-border complexity is real—currency, legal, tax, payment security all require expertise

- Access to serious buyers matters most—PE firms and strategic acquirers rarely found on marketplaces

Whether you’re ready to sell now or planning for 12-18 months out, understanding what your business is worth to international buyers—and how to access those buyers safely—is the first step to maximising your outcome.

Ready to Learn Your International Market Value?

Get a comprehensive, no-obligation valuation from Australian M&A specialists with international buyer access:

- Expert analysis using 2026 international market data

- Comparison to recent Australian and US SaaS sales

- Assessment against international buyer requirements

- Cross-border considerations (currency, tax, legal)

- Improvement recommendations

- No pressure, no obligation

About Digital Asset Brokers

Digital Asset Brokers is Australia’s specialist in selling online businesses to international buyers. Based in Melbourne, we provide Australian SaaS, eCommerce, tech, content, and AI business founders with direct access to 40,000+ qualified international buyers through our exclusive partnership with Website Closers (USA). We handle all cross-border complexity—currency, legal coordination, escrow, payment security—whilst you maintain the comfort of working with an Australian team in your time zone. With $50M+ in successful transactions and a 94% success rate, we’re committed to helping Australian founders achieve international valuations.

Disclaimer: This article provides general information about SaaS valuations and is not financial, legal, or tax advice. Consult appropriate professionals before making decisions about selling your business.

Published: February 2026

Author: Digital Asset Brokers Team

Location: Melbourne, Australia

Reading Time: 24 minutes

Category: SaaS Valuation, Australian Business Exit, International M&A

Author: Digital Asset Brokers Team

Location: Melbourne, Australia

Reading Time: 24 minutes

Category: SaaS Valuation, Australian Business Exit, International M&A