The Complete Guide to Selling an Online Business in Australia (2025 Update)

Selling an online business can be one of the most rewarding moves you’ll make as an entrepreneur. Whether it’s an eCommerce store, a SaaS company, or a content site, the market in 2025 is strong — and buyers are paying premiums for well-run digital businesses.

In this guide, we’ll walk you through:

- How to value your business accurately

- How to prepare it for a premium sale

- Where to find the right buyers

- How to negotiate and close effectively

Why 2025 Is a Great Time to Sell an Online Business

- Rising Buyer Demand: Investors seek stable, cash-flowing online assets.

- Global Buyer Pool: Australian businesses attract overseas investors.

- Currency Advantage: Favourable exchange rates boost sale prices.

Example: We recently brokered a SaaS sale where an overseas buyer paid 15% more than local offers.

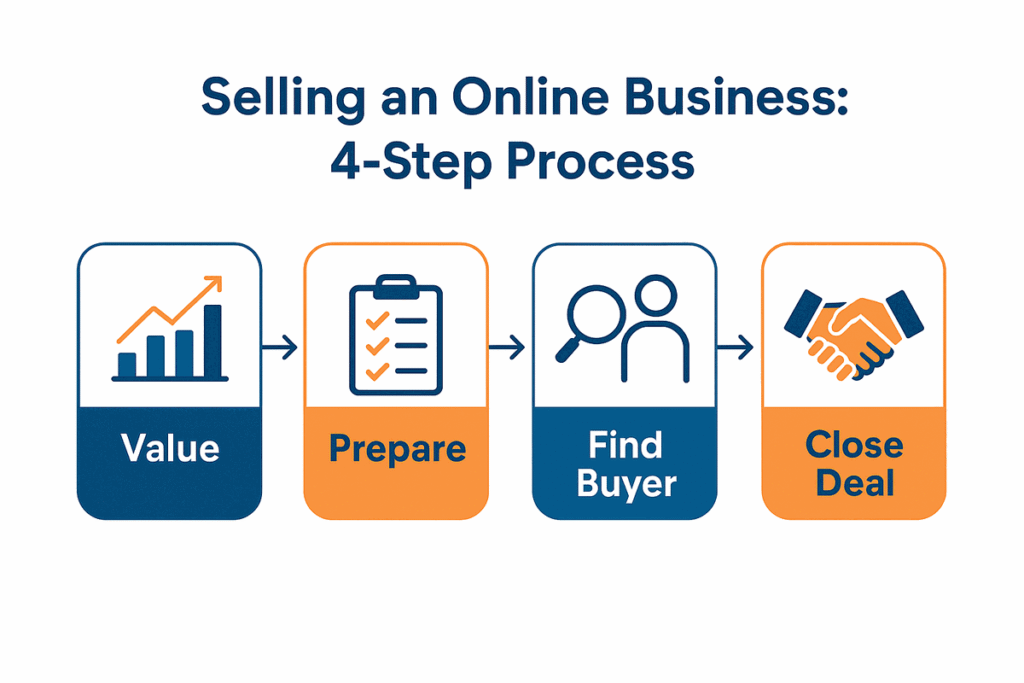

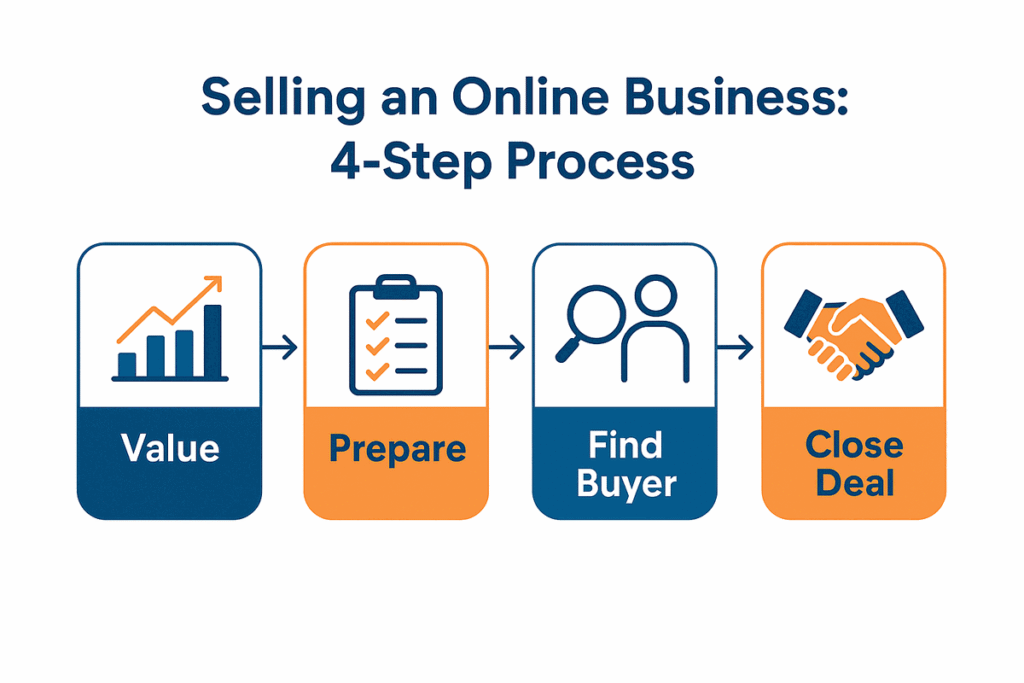

Step 1 – Understanding the Value of Your Online Business

The Main Valuation Models

- SDE: Best for small, owner-operated businesses.

- EBITDA: Best for larger companies with management in place.

Key Factors Influencing Value

- Profitability

- Revenue Model (recurring > one-off)

- Customer diversification

- Traffic quality

- Operational simplicity

Step 2 – Preparing Your Business for Sale

Preparation can add 20–40% to your sale price.

Financial Preparation

- Maintain 2–3 years of clean P&L statements.

- Separate personal from business expenses.

Operational Preparation

- Document SOPs.

- Delegate key tasks.

Digital Preparation

- Conduct SEO audit.

- Speed up site performance.

- Secure trademarks & IP.

Step 3 – Finding the Right Buyer

1. Using a Specialist Broker

Access to a network of pre-qualified buyers, professional negotiation, and higher close rates.

2. Online Marketplaces

Platforms like Flippa, Empire Flippers, and FE International. Wider audience but more DIY.

3. Private Sales

Direct to competitors or suppliers. Can be faster, but requires careful legal protections.

Step 4 – Negotiation & Closing the Deal

Common Deal Structures

- Full Cash Sale: Ideal, but less common in large deals.

- Earn-Outs: Part upfront, rest tied to future performance.

- Seller Financing: Seller finances part of the deal, earning interest.

Closing Steps

- Letter of Intent (LOI)

- Due diligence

- Purchase agreement

- Transition period

Common Mistakes to Avoid

- Waiting until profits decline

- Poor financials

- Overestimating value

- Accepting first offer

- Not vetting buyers

The Australian Market Outlook

Online business sales in Australia are on a steady rise thanks to investor demand and tech-friendly infrastructure.

Final Checklist

- ✅ Clean financials

- ✅ Documented processes

- ✅ Diversified revenue & traffic

- ✅ Protected IP

- ✅ Right sales channel chosen

Conclusion & Next Steps

Selling your online business in 2025 can be a life-changing move. With Digital Asset Brokers, you’ll have access to expert valuation, a network of serious buyers, and proven negotiation strategies to secure the best possible price.

📞 Contact Us Today for a free, confidential valuation.